Steady demand continued for the single-family rental (SFR) industry in the first half of 2024. SFR new lease asking rent growth continues to rise year over year (YOY) at a more normalized rate in most markets. We are watching moderating to flat SFR rent growth in markets with increasing for-sale supply trends (namely in Florida and Texas markets).

Overall, the supply/demand dynamics support continued rent growth in 2024 and beyond.

We are watching key metrics driving our SFR thesis and expectations for 2024 and beyond.

The economy remains strong, driven by solid job growth, strong immigration, and rising incomes YOY (albeit at a slower pace than in recent years).

- We do not expect outright job losses in 2024 and are forecasting +1% annual job growth for the year.

Home prices are rising YOY across most top housing markets, though resale home prices show signs of moderating growth in many markets.

- Although resale inventory is still low, resale supply is rising YOY across most housing markets and particularly quickly in pockets of Florida and Texas.

- We forecast national home price appreciation to rise +3% YOY in 2024, +3% YOY in 2025, and +4% YOY in 2026 and 2027.

National SFR occupancy at 94.5% is trending slightly above the historical average, per the U.S. Census (see page 65 of the report)—correlating with healthy rent growth.

For-sale affordability challenges put homeownership out of reach and support demand for SFR, primarily through longer tenant retention.

- Nationally (across the 99 SFR markets), the monthly mortgage payment to purchase a typical single-family starter home exceeds the monthly SFR rent by $1,242 on a similar home.

- Across the top 20 SFR markets, the spread between purchasing and renting a home ranges from $113 (Cincinnati) to $2,085 (Austin).

Notes: A negative number means purchasing and maintaining a home costs less than renting an equivalently valued one. National rollup is a weighted average of 99 markets.

Source: John Burns Research and Consulting, LLC (Data: Apr-24, Pub: Jun-24)

We are watching markets with rising for-sale supply (namely Florida and Texas).

As for-sale listings rise, we expect new SFR listings to rise as well, which could lead to moderating rent growth.

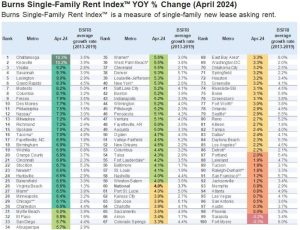

Single-family new lease asking rent growth across many of the 99 SFR markets is trending closer to long-term norms (2013–2019).

- Several Florida and Texas markets have seen flat to moderating rent growth YOY (see the table below).

- Several larger markets with slower SFR new lease asking rent growth (e.g., Las Vegas, Austin, Phoenix, and San Antonio) saw an influx of build-to-rent and apartment construction this cycle—which may compete with single-family rental demand.

Notes: *Metropolitan division **Combination of metropolitan divisions, except Raleigh-Durham, which is a combination of metros. Burns Single-Family Rent Index is a measure of single-family new lease asking rent.

Source: John Burns Research and Consulting, LLC (Data: Apr-24, Pub: Jun-24)

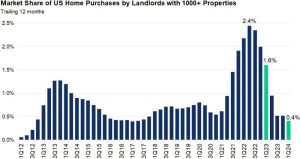

Higher financing costs have impacted SFR purchases. However, the impact of investors varies significantly by market and investor segment.

- Nationally, institutional investors (owners of 1,000+ homes across the entire portfolio) account for just 3% of total investor-owned SFR homes, with mom-and-pop investors (1–9 homes) owning the majority of SFR homes (71%).

- On a trailing-12-month basis, institutional investors (with 1,000+ homes) account for 0.4% of US home purchases in 1Q24, decelerating from the 2.4% peak in 2Q22.

Note: A calculation of home sale closings with different zip codes for the property and the owner’s mailing address for tax statements, categorized by the number of properties owned in the US. This includes only sales where both the site and mail zip codes are known. Includes new and existing homes.

Data for institutional investors (1000+ properties) does not include iBuyers.

Source: JBREC analysis of public records data for transactions and ownership (Data: 1Q24, Pub: Jun-24)

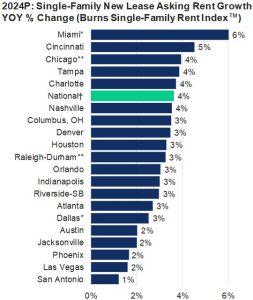

Our 2024 single-family new lease asking rent growth forecasts align with recent SFR REIT results.

We forecast single-family new lease asking rent growth of +3.6% YOY nationally in 2024—which ties closely with the May 2024 commentary and the results the SFR REITs provided in early June.

May 2024 same-home (quarter-to-date) new lease rent growth:

- INVH: +3.5%

- AMH: +5.4%

We expect SFR new lease asking rent growth to remain positive nationally through 2027.

We expect resilience for the SFR industry. Our national SFR new lease asking rent growth forecasts are as follows:

- +3.6% in 2024

- +3.7% in 2025

- +4.0% in 2026

- +4.0% in 2027

We expect single-family new lease asking rent growth to range from +1% to +6% across the top 20 SFR markets, much more in line with historical norms than 2020–2022.

*Metropolitan division **Combination of metropolitan divisions, except Raleigh-Durham, which is a combination of metros.

Note: Burns Single-Family Rent Index is a measure of single-family asking rent.

†: We base the National rollup on a weighted average of 99 markets. Actual values may vary slightly due to rounding.

Source: John Burns Research and Consulting, LLC (Pub: Jun-24)

Important updates to our single-family rental membership and research this quarter

We have updated insights from our survey of SFR operators that shine a light on acquisition assumptions.

- Assumed stabilized cap rates at acquisition

- Spend on renovations/repairs for each home acquired in the last 12 months

- The average age of SFR homes acquired during the previous 12 months

As a reminder, we moved our Build-to-Rent Overview section into the Rental Communities Analysis and Forecast report. This report presents a comprehensive view of the rental market, analyzing the interplay of build-to-rent (BTR) and apartments.