Despite elevated mortgage rates, new home demand continued for the public homebuilders in 1Q24. A combination of incentives, mortgage rate buydowns, and limited resale competition are key factors in the ongoing strength of the “Goldilocks” new home market (not too hot nor too cold).

As a reminder, this report is backward looking. As we progress through the spring selling season, we are monitoring the impact of mortgage rates hovering at ~7%+ on traffic and sales.

We combed the 19 homebuilder earnings calls from February 21, 2024, to May 10, 2024. In general, public homebuilders are:

- Offering rate buydowns (primarily for entry-level buyers) and building smaller homes to help with affordability challenges

- Builders are ramping up starts/spec inventory to meet buyer demand for the spring selling season with move-in-ready inventory.

- Accelerating land acquisition and development to match rising sales and to take advantage of still limited resale supply in most markets

- Several builders emphasized a focus on growing their land pipelines via land banking or option financing for 2024 and beyond. This strategy allows them to de-risk their balance sheets while still focusing on growing their land holdings.

- Lot and land costs are elevated and expected to accelerate as builders replenish their land pipelines.

- Taking market share from smaller private builders thanks to lower cost of debt, access to more capital to buy land and offer enticing rate buydowns, and the size and scale to negotiate costs

(See the high-level themes on pages 64–82 of the report.)

The forward-looking commentary highlights a cautiously optimistic outlook for 2Q24 and the spring selling season.

Builders noted:

- Sales momentum continued into April, yet builders had mixed feedback. Some builders reported moderating traffic due to the recent increase in mortgage rates, while others saw continued strength.

- Builders generally prioritize pace over price, especially in the very low resale inventory environment (though listings are slowly trending up in several markets).

- Builders expect incentives (namely rate buydowns) to remain elevated for now, given the higher-for-longer interest rate environment.

- Several builders note testing the waters on price increases and pulling back on incentives within certain communities where there is pricing power.

- Builders are guiding to healthy 2024 community count growth.

- Builders are starting more homes to meet buyer demand and support higher orders, assuming demand holds through the spring selling season.

- Cost pressure (except land/lot costs) and supply chain relief are improving.

- For several builders, cycle times are back to pre-Covid norms, and many expect them to continue normalizing into 2024.

In 1Q24*, the 19 publicly traded builders achieved the following.

Market share, cancelation rate, orders, and absorptions

47% new home sales market share, with DHI (13%) and LEN (11%) accounting for 24% alone

13% average cancelation rate, improving from 19% one year ago

- Cancelation rates are back to normal/healthy levels.

+19% YOY increase in sales/orders, as rate buydowns keep boosting sales

- +8% YOY community count growth, with more homes coming online as builders replenish communities

- 1Q24 was the 10th consecutive quarter showing positive YOY growth, signaling more supply coming to market in 2024.

- +11% YOY increase in sales rates (absorptions), achieving 4.1 sales per month per community (rising from 3.7 sales per month per community in 1Q23)

- LGIH, LEN, MTH, NVR, KBH, and DHI posted 4.6+ sales per month per community in 1Q24.

Closings and price

+15% YOY higher closings, as builders benefit from easing supply chain constraints and improving cycle times

- -3% YOY decrease in average sales price at $456K

- We will monitor prices (ASP on closings) as builders offer incentives, buydowns, and build smaller homes. Note: Mix shift skews ASP.

Backlog

-7% YOY decrease in backlog as builders continue to deliver more homes under construction as cycle times improve

- Backlog conversion (trailing-four-quarter average) rose to 78% in 1Q24 and is now above pre-Covid norms as backlog shrinks and supply chain bottlenecks improve.

- Some builders have increasingly been selling and closing homes within the same quarter, driving up their backlog conversion rate.

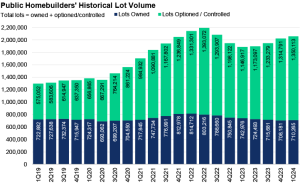

Lots

Total lots (owned + controlled) rose +9% YOY as builders replenished their land portfolios (see the graph below).

- Builders are accelerating lot and land acquisition strategies as demand holds steady to match the current sales pace.

- Strategies for land holdings vary by builder through the use of lot options or owning lots.

- Thanks to optioning lots, builders have the option to renegotiate or walk away. This trend has been generally upward as builders work to de-risk their balance sheets.

Note: Total lots includes both owned and optioned/controlled lots

Note: UHG is not included in this graph due to inconsistency in reporting this metric historically.

Sources: Bloomberg, public homebuilder public filings, John Burns Research and Consulting, LLC (Data: Homebuilders’ most recent quarter, Pub: May-24)

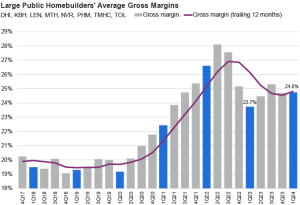

The 8 largest publicly traded builders** reported steady, though moderating, financial results in 1Q24 (reflected in closings, which are backward looking).

Here is how they fared over the last 12 months:

- +1% higher revenue YOY

- -7% lower net income YOY

- Rising, but low SG&A: 8.7% SG&A vs. 8.1% one year ago

- 24.8% gross margin for 1Q24 (not smoothed across the last 12 months), rising compared to 23.7% in 1Q23 (see the graph below). Though below the all-time high set in 2Q22 of 28.1%, gross margins are significantly higher than more normalized years for housing from 2017–2019, when margins averaged roughly 19%–20%.

- Strong gross margins give builders a buffer to offer financial incentives like rate buydowns while remaining profitable.

*Data in the report reflects the builders’ most recent earnings report.

**Builders tracked: DHI, KBH, LEN, MTH, NVR, PHM, TMHC, and TOL.

Sources: Bloomberg; public home builder public filings; John Burns Research and Consulting, LLC (Data: Builders’ most recent quarter, Pub: May-24)

Notes:

Actual values may vary slightly due to rounding.

Sekisui House completed the acquisition of M.D.C. Holdings (MDC) on April 19, 2024. MDC is included in this report as they reported 1Q24 earnings. Beginning next quarter, MDC will only be included in historical rollups when the company was public.

United Homes Group (UHG) went public March 30, 2023. We added UHG to the report since the builder has now reported at least four quarters of earnings.

Smith Douglas Homes (SDHC) debuted as a public builder (IPO) in January 2024. We will add SDHC to this report once the company releases a full year (4 quarters) of quarterly earnings data.

We summarize each company’s earnings call and post it to your client portal shortly after the call. To prevent email overload, we do not send out an email for each summary.

To find these summaries:

- Log in to your client portal.

- Navigate to the My Research menu.

- Click on Public Companies’ Earnings Call Summaries.

- Click on Homebuilder Earnings Call Summaries.