- SVN Commercial Partners

- Aug 27, 2024

- 4 min read

Updated: Sep 25, 2024

2Q24 is healthy for SFR REITs; eyes are on supply

Steady rent growth continued for the SFR REITs in most markets in 2Q24. The SFR REITs reported solid occupancy but are monitoring the impact of rising for-sale resale supply. Increasing supply may impact occupancy and rent growth—especially in the heavy-supply markets.

After several years of robust demand, the SFR REITs are seeing a return to expected seasonality, with rent growth trending toward more historical norms.

Keep in mind that this report looks backward, and with the seasonally slower part of the year ahead, the SFR REITs note prioritizing occupancy amid cooling rent growth.

We listen to and summarize SFR REIT earnings calls every quarter

Healthy occupancy and rent growth in 2Q24

Markets (namely in Florida, Texas, and the Southwest) with rising for-sale supply or a surge in build-to-rent deliveries feel short-term pressures on occupancy and rent growth. Historically, rising for-sale supply typically trickles down to more for-rent supply.

For-sale affordability challenges, healthy tenant retention, and strong financial health support demand for SFR.

Capital recycling through strategic acquisition/disposition opportunities

Exploring build-to-rent or purchasing homes directly from builders to help grow and diversify portfolios

INVH’s current pipeline includes nearly 2,700 new homes planned to be made available for lease over the next few years and the ~2,000 homes delivered since 2021.

AMH continues to focus on its AMH Development Program, which includes ~11,000+ units in a land pipeline, to bring new supplies to the housing market.

Elevated operating expenses due to higher property taxes (which account for roughly half of total expenses) should eventually moderate compared to the last couple of years as home price appreciation decelerates.

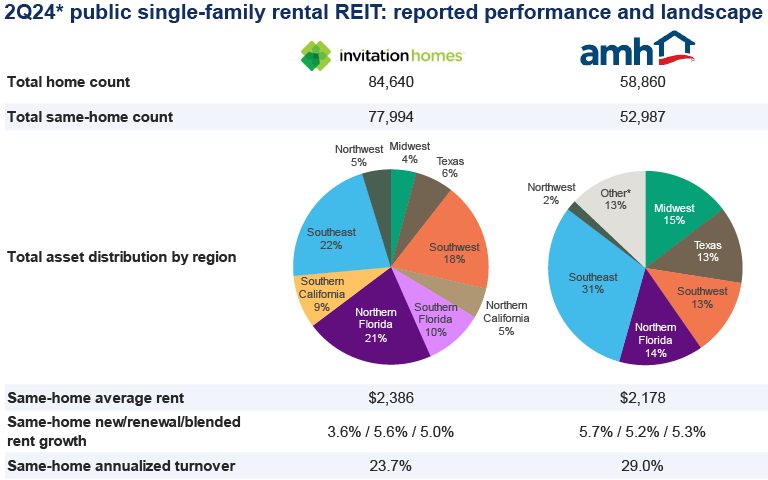

In 2Q24, the 2 public single-family rental REITs that own and manage 143,500 total homes reported the following same-home results (weighted average)

97% same-home occupancy, which is still high and above pre-Covid levels

SFR REITs typically prioritize occupancy in the seasonally slower quarters.

+4.5% same-home new lease rent growth

Same-home new lease rent growth accelerated sequentially and returned to pre-pandemic levels after cooling from a record-high +18% in 3Q21.

The SFR REITs pushed new leases the most in Atlanta and Houston

(+5%) for the 8 markets where they both have a footprint.

Conversely, new lease rent growth has cooled in Phoenix (+1%).

+5.4% same-home renewal rent growth, moderating from peaks seen in 2022—though still above pre-pandemic levels

$2,301 same-home average monthly rent

66% same-home NOI margins vs. 67% a year ago

Same-home annualized turnover of 26% in 2Q24, still very low historically.

SFR REIT market-level statistics have improved in the spring leasing season—but have steadily trended down from unsustainable highs

Markets, where the SFR REITs are reporting the strongest same-home new lease rent growth, include:

Atlanta (+5%), Houston (+5%), Orlando (+4%),and Dallas (+4%)

Markets where the SFR REITs are reporting the slowest same-home new lease rent growth include:

Jacksonville, FL (+3%), Tampa, FL (+3%), Las Vegas (+3%), and Phoenix (+1%)

The SFR REITs reported 96%–97% same-home occupancy rates across the top 8 markets (where both SFR REITs have a footprint).

Note: Data reflects weighted averages for the top 8 markets where all the REITs report metro-level data (Atlanta; Dallas; Houston; Jacksonville, FL; Las Vegas, Orlando; Phoenix; and Tampa, FL).

Note: Average same-home new lease rent growth is REIT-reported rent per market weighted by asset count for INVH and AMH. TCN went private and stopped reporting in 4Q23. TCN was included in historical rollups when the company was public.

2Q24 commentary from the SFR REITs reflects healthy demand and an expected return to the seasonally slower part of the year

“Looking ahead, as the summer leasing season comes to a close, we expect to see a normal degree of seasonality return to our portfolio. While we still have a week remaining here in July, we anticipate that new lease rate growth likely peaked in May and June, as it typically does, and that occupancy this month and next will reflect the usual summer move-outs and a normal seasonal curve. That being said, we expect to continue to lean in on occupancy, particularly as we move deeper into the 2nd half of the year, as occupancy is traditionally our most impactful core revenue growth driver.”

“For July, same-home average occupied days remained strong at 96.3%. This was in line with our expectations and reflects the impact of the start of the move-out season. Leasing spreads continued to hold steady, with new and renewal rate growth of +6.2% and +5%, respectively.”

“July was strong. We’re sending out, we’re mailing renewals in the low 5s.”

Actual values may vary slightly due to rounding.

Blackstone Real Estate finalized the acquisition of Tricon Residential on May 1, 2024—taking Tricon Residential private. With this, TCN went private and stopped reporting in 4Q23. TCN was included in historical rollups when the company was public.

TCN and RESI were included in historical rollups when the companies were public. We also provided 4Q23 TCN insight for recent market color.

Data is collected from company public filings and earnings call transcripts.

Commentaires